Digital Asset Exchange Systems

8+ years of market validation and 3 major technical iterations. Enterprise-grade matching engine with multi-layer security architecture.

Technical & Product Advantages

High-performance Matching

Distributed matching engine with high concurrency and low latency, stable under extreme market conditions.

Security & Compliance

KYC/AML, anti-money laundering risk controls, hot/cold wallet isolation and multisig to meet institutional compliance.

Observability

End-to-end monitoring, alerting and audit trails with SLA-grade uptime and efficient operations.

Scalability

Microservices and multi-active deployment supporting multiple business lines and global regions.

Standard Features

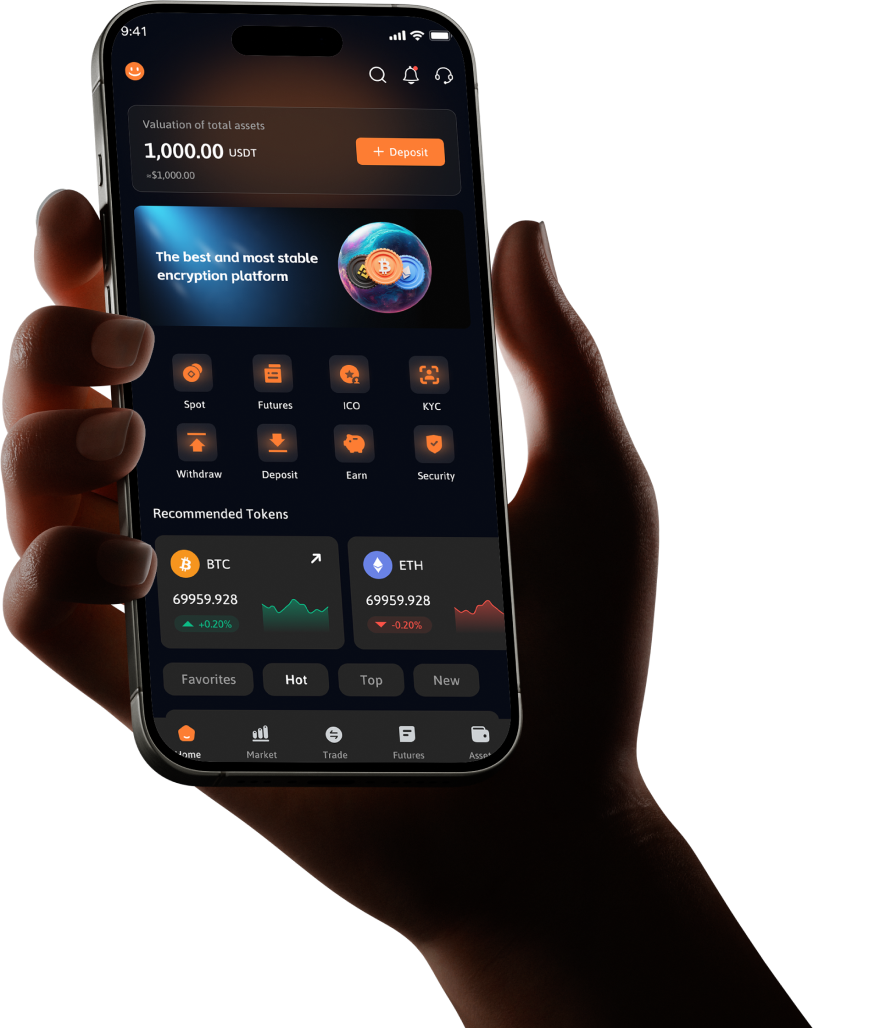

Spot, derivatives and simple options with real-time market data across multi-end clients.

Customizable Capabilities

On-demand: options, stock-crypto linkage and more advanced modules

Options trading (European/American; structured products)

Stock-crypto linkage (quotes/trading integration)

Advanced orders (Iceberg/TWAP/VWAP/time-weighted)

Market making and hedging systems

Broker/sub-accounts and clearing/settlement

Quant API access (WebSocket/REST)

Ready to build your exchange system?

Get expert consultation tailored to your business needs for a digital asset exchange solution.